The market for e-sports video continues its rapid growth worldwide. Total hours viewed in the genre exceeded 6 billion globally in 2016, up 19% from 2015, according to a new report entitled Esports and The Future of TV from IHS Markit.

The market for e-sports video continues its rapid growth worldwide. Total hours viewed in the genre exceeded 6 billion globally in 2016, up 19% from 2015, according to a new report entitled Esports and The Future of TV from IHS Markit.

Online viewing is driving the esports video market, accounting for more than 85% of time spent watching esports. China is by far the largest market for esports video, accounting for 57% of all viewing last year. The number of video streams delivered in China totaled 11.1 billion in 2016, compared with North America, the second-largest market, with 2.7 billion video streams.

“The rapid growth of esports audiences has attracted some the industries’ largest media and technology companies to the genre, with the likes of Amazon and MTG acquiring key assets,” said Ted Hall, research director for IHS Markit and the report’s lead author.

“Some of these acquisitions are initiating shifts in esports business dynamics, with players such as China’s Tencent seeking to control assets across the value chain, and publishers moving into league operation.

“Investment in esports will pay off for its big-name backers, as the genre expands both within its target demographic and outside it, with increasing exposure on linear TV set to bring in casual and new fans,” Hall said.

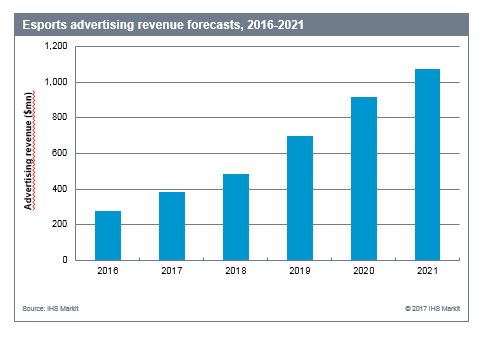

Esports’ prospects for generating advertising revenue are expected to mirror the genre’s audience growth trend, IHS Markit says. Esports advertising totaled about $280 million globally in 2016, with the category expected to become a $1 billion advertising industry by 2021. This growth will be primarily driven by video, influencer marketing and sponsorship.

According to Dan Cryan, senior director, IHS Markit, and another of the report’s authors, e-sports video provides a view, in microcosm, of changes that are happening across the TV business.

“The rise of esports provides some valuable lessons for channels and programmers more broadly,” Cryan said. “In particular, it demonstrates the value of aggregating audiences globally, rather than the more country-specific approach that defined much of the traditional TV business.

“E-sports video is a perfect example of the increasingly complicated competitive landscape in TV. In the ‘old world,’ broadcasters would compete with broadcasters and pay TV operators would compete with pay TV operators,” Cryan said.

“Today, an emerging class of new entrants competes for audiences driven by objectives and business models that are orthogonal to traditional TV. This is not just online channels taking a traditional business model and moving it online, this is something new. Publishers, for example, deliver esports video because it helps their other commercial interests rather than having content monetization as their primary focus. This sort of competitive diversification is set to become more common and spread to other genres with time.”