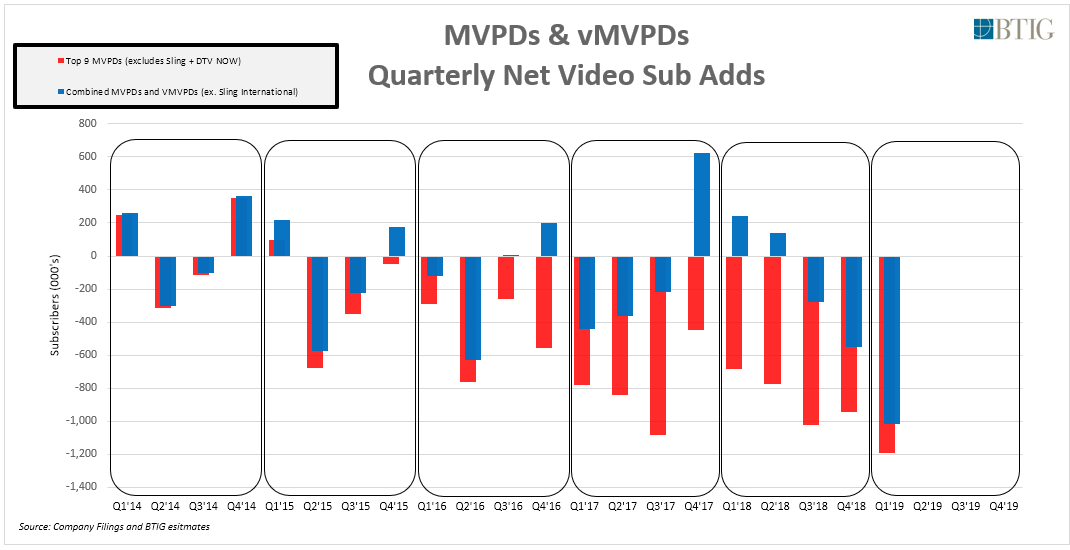

The first quarter of 2019 marked the worst ever for cord-cutting, with over 1.1 million fleeing bundle, according to BTG Research.

The first quarter of 2019 marked the worst ever for cord-cutting, with over 1.1 million fleeing bundle, according to BTG Research.

These figures confirm similar research from the Multiscreen Index by Informtv. It’s not a pretty picture for what American call ‘multichannel video programming distributors’ (MVPDs) or traditional cable and satellite providers such as DirecTV, Comcast and Dish.

Back in February 2019 BTG Research noted industry multichannel video subscriber trends inflected in Q3 2018, with Q4 2018 materially worse leading to forecast a notable acceleration in cord-cutting trends throughout 2019. Q1 2019 did not disappoint, with vMVPD growth slowing dramatically year-over-year and facilities-based MVPD losses hitting record levels, leading to the worst multichannel video quarter sub loss quarter in history.

Total MVPD/vMVPD sub losses for tracked companies were just over 1 million (1.02 million) compared to a net gain of 245,000 in Q1 2018 and if you adjust for the disconnect policy at DirecTV, the losses in Q1 2019 were actually over 1.1 million, which is a doubling of the absolute number of subs lost in Q4 2018 (~553,000) and almost 4x the rate of loss in Q3 2018 (~277,000).

Here is what happened in Q1 2019:

-vMVPD net adds slowed from 933,000 in Q1 2018 to just 174,000 in Q1 2019 (now at 8.1 million in total, a bit under 8 million excluding Sling International subs).

– MVPD (facilities-based) net losses increased from 682,000 in Q1 2018 to nearly 1.2 million in Q1 2019 and that includes the benefit of 117,000 from a change in the disconnect policy at DirecTV – removing that change, apples-to-apples losses were over 1.3 million in Q1 2019 alone, a 90% increase from Q1 2019.

– Total subs of companies tracked were down nearly 2% year-over-year (represents over 90% of the multichannel video industry) and should begin to negatively impact broadcast and cable network programmer retrans/affiliate revenues in Q2 2019 given the lag in reporting.

– Worth remembering that while vMVPDs are paying higher rates for programming, vMVPD churn is dramatically higher than facilities-based MVPD churn (so easy to cancel).