The number of TV connections in the Netherlands has dropped by 0.1% during the first quarter of 2018 to 7.47 million.

The number of TV connections in the Netherlands has dropped by 0.1% during the first quarter of 2018 to 7.47 million.

Ziggo is still the largest provider with more than 52% followed by KPN with almost 32% market share. Behind them a group of three parties is emerging with a market share of between 4 and 5% on the television market: Canal Digitaal and Online.nl (M7 subsidiaries), Delta/Caiw (EQT is owner) and the announced combination of T-Mobil/Tele2 Netherlands.

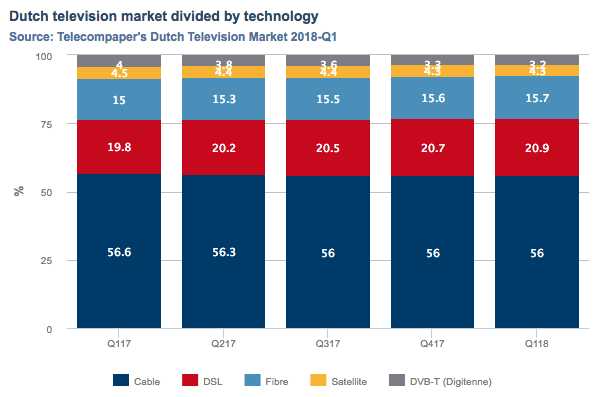

The quarterly decline came from growth in IPTV via DSL and fibre being not enough to off-set the continued decrease of traditional TV networks (cable, satellite and Digitenne/DVB-T), according to Telecompaper’s most recent quarterly report about the Dutch television market.

Despite a drop of 0.2% during the quarter cable is still the largest TV technology with 56% of all subscribers, followed by DSL with almost 21% market share. Fibre is the third largest with a market share of 15.7% and both satellite and DVB-T (Digitenne by KPN) had a market share smaller than 5 % with satellite having slightly more than DVB-T.

M7, Delta/Caiw and T-Mobile/Tele2 at clear distance from Ziggo and KPN

With a market share of 52.4% Ziggo is the largest provider with regards to TV connections. Its share has been stable since Q3 2017. Number two is KPN with 31.8% market share, stable during the first quarter and up by 0.6 percentage points compared with Q1 2017. Behind those two clear market leaders, a group of three players with a market share of between 4 and 5% is emerging. The largest of that group is M7 including satellite TV provider Canal Digitaal and IPTV provider Online.nl. Together these providers have a joint market share of 4.8% at the end of Q1 2018, which is 0.4 percentage points down compared with Q1 2017.

The second combination is Delta and Caiway, both acquired by Swedish investor EQT with a joint market share of 4.4 percent. This is 0.1 percentage point less than in Q1 2017 as Caiway’s TV customer growth on fibre networks in rural areas was not enough to off-set the decrease of Caiway and Delta’s cable TV customers.

The announced combination between T-Mobile and Tele2 in the Netherlands would have a joint market share of 4.2 percent of the Dutch TV market in Q1 2018. This is 0.1 percentage point more than in Q1 2017 as T-Mobile’s TV customer growth is enough to compensate a small decrease for Tele2. The merger between the two companies is still under review by the European Commission.

TV revenues still growing, downturn expected from 2020

The revenues from TV services for the mass market (consumer + SoHo) decreased with EUR 1 million during Q1 2018 to EUR 463 million. For the full year 2018, Telecompaper expects that the revenues will grow with 2.3 percent to EUR 1.88 billion, with the price hikes as announced by KPN, Telfort, XS4ALL, Ziggo, Delta and Caiway will cause a growth acceleration in the second half of 2018.

For the coming years, Telecompaper expects revenues to continue growing in 2018 and 2019, but then start declining from 2020. As a result, the expected average growth is 0 percent for the years up to and including 2022.

For 2018, Telecompaper expects TV connections to fall by 1%. The accelerated decline will be partly caused by the expansion of analogue cable television Ziggo and Delta will start this year. In addition, the influence of cord-nevers and cord cutters, which watch TV and video via the internet, is on the up. For 2018-2022 Telecompaper expects a decrease of an average of 0.8 percent per year in TV connections.