Apple TV+ and Paramount+ are the most popular services for US SVOD switchers, defined as those who move from one subscription service and commit to another contract within 60 days.

Apple TV+ and Paramount+ are the most popular services for US SVOD switchers, defined as those who move from one subscription service and commit to another contract within 60 days.

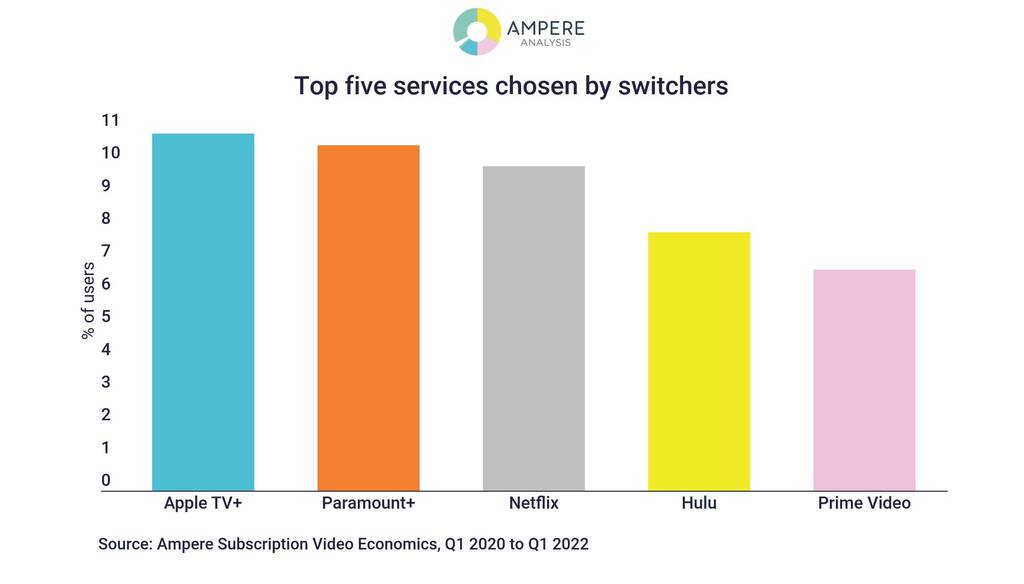

According to a report by Ampere Analysis, Apple TV+ and Paramount+ are the most widely chosen platforms for this sub-group of churning streaming customers. Of all switchers across all platforms, 11% chose Apple TV+ and an equal proportion selected Paramount+, with Netflix being third choice.

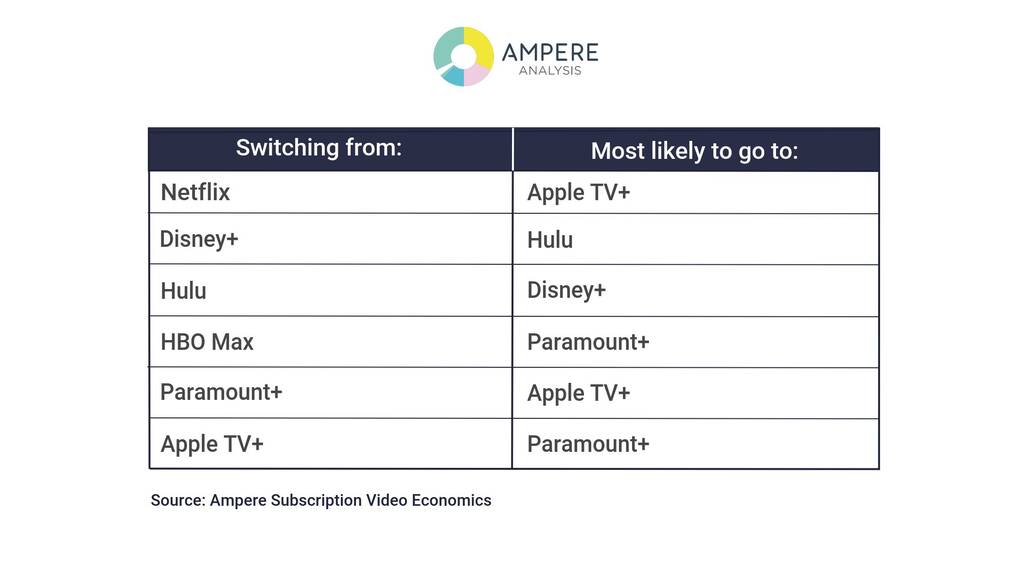

The report, which looks at the 27-month period between Q1 2020 and Q1 2022, shows not only which competitors are most likely to take direct spend from each US streaming service (because switchers are specifically moving their spend from one service to another), but also how existing in-home service choices impact the direction of switching platform. Apple TV+ is the first choice for Netflix deserters, but Prime Video and Hulu are close seconds. Those leaving Netflix have been less adventurous in trying new services than switchers from other streaming services: they currently have the lowest number of streaming services among leavers from any of the major platforms.

The report also notes that providers with a family of streaming services benefit from the bundling effect in terms of cross-promotion, greater average revenue per user opportunities and customer retention. The advantages are especially clear for Disney+. The most popular next service for Disney+ switchers is its sister platform Hulu. Similarly, Hulu switchers’ first choice is a Disney+ subscription.

A similar effect is also seen among Paramount+ churners. While Apple TV+ is the first choice and Netflix the second, switchers choose Showtime (owned by Paramount) as their third choice.

A similar effect is also seen among Paramount+ churners. While Apple TV+ is the first choice and Netflix the second, switchers choose Showtime (owned by Paramount) as their third choice.

Overall, around 30% of streaming subscribers switch services in any given two-month period. Of users who leave a service, just over half (56%) choose not to re-subscribe or switch to a new service within two months. However, 14% of customers leaving a platform return within two months, and this boomerang behaviour reduces effective churn rate.

Significantly, Netflix leavers are most likely to boomerang: 23% of its churners resubscribe within two months. The comparable rates for other services are 11% for Disney+ and Hulu, 10% for Apple TV+, and 15% for both HBO Max and Paramount+.

The study also shows that higher-spending high-stack households are engaging in ‘dipping’, or moving in and out of services higher up the stack. Smaller services are currently being taken in homes that are already avid SVOD watchers and chasing more variety. By contrast, those with only one or two streaming services are content for now with the major providers and tend to move between the big two or three streaming choices.

Commenting on the findings of the report, its author and analyst at Ampere Analysis Ben French said:: “This sub-group of churning streamers are particularly interesting because they represent customers who, rather than simply adding a new service on to their existing in-home bundle, are deliberately transferring spend from one to another. As such it shows where each platform needs to look for its direct competition. Switchers are experimenting with different platform mixes within the home, moving spend to some of the newer and less penetrated services while maintaining a core base of services. It’s some of these newer, smaller services that the incumbent streamers most need to keep an eye on”.