A double wave of merger and acquisition activity will be the trend to watch this year in the TV industry, according to Ampere Analysis.

A double wave of merger and acquisition activity will be the trend to watch this year in the TV industry, according to Ampere Analysis.

As players now have a good understanding of what is required to maintain market position from a content perspective in this fiercely competitive global landscape, the industry is entering a new phase that Ampere predicts will be characterised by structural positioning.

According to Ampere’s research director Guy Bisson: “Success in streaming today means capture and retain: capture the viewer and then keep them happy enough to stick around. That strategy relies on both popular content and new original debuts with both a bang (impact that grows and engages the customer base) and longevity. To achieve this, 2022 will herald the start of a new wave of M&A activity that will position the TV market for on-going growth and align companies along the key verticals needed to service a global streaming-first TV content and distribution market.

“One wave will focus on content Intellectual property where acquisition targets will include traditionally established TV production entities with a track record of creating character-driven content franchises, as well as publishers, games studios, comic creators, toys, music catalogues, TV and movie libraries and archives that have the same proven abilities.

Another wave is likely to see the return of large-scale vertical integration, although the alignments will differ from the combinations that characterised the last great wave of content-plus-distribution mega-mergers in the nineties and noughties”.

Bisson says we can think of these restructuring waves around two broad types of company that have been shaped by the needs of global streaming: ‘Feeders’ who currently make content available for international licensing, and ‘Deliverers’ – the consumer facing content platforms who increasingly make programming primarily for their own channel or streaming service.

Feeders now need scale to survive in the new global TV market, so they will be aiming to grow their geographic footprint and the breadth of their production assets by executing classic horizontal mergers. As Feeders scale, they also become acquisition targets for the Delivers, eager to make and access more content that meets the ‘capture and retain’ principle.

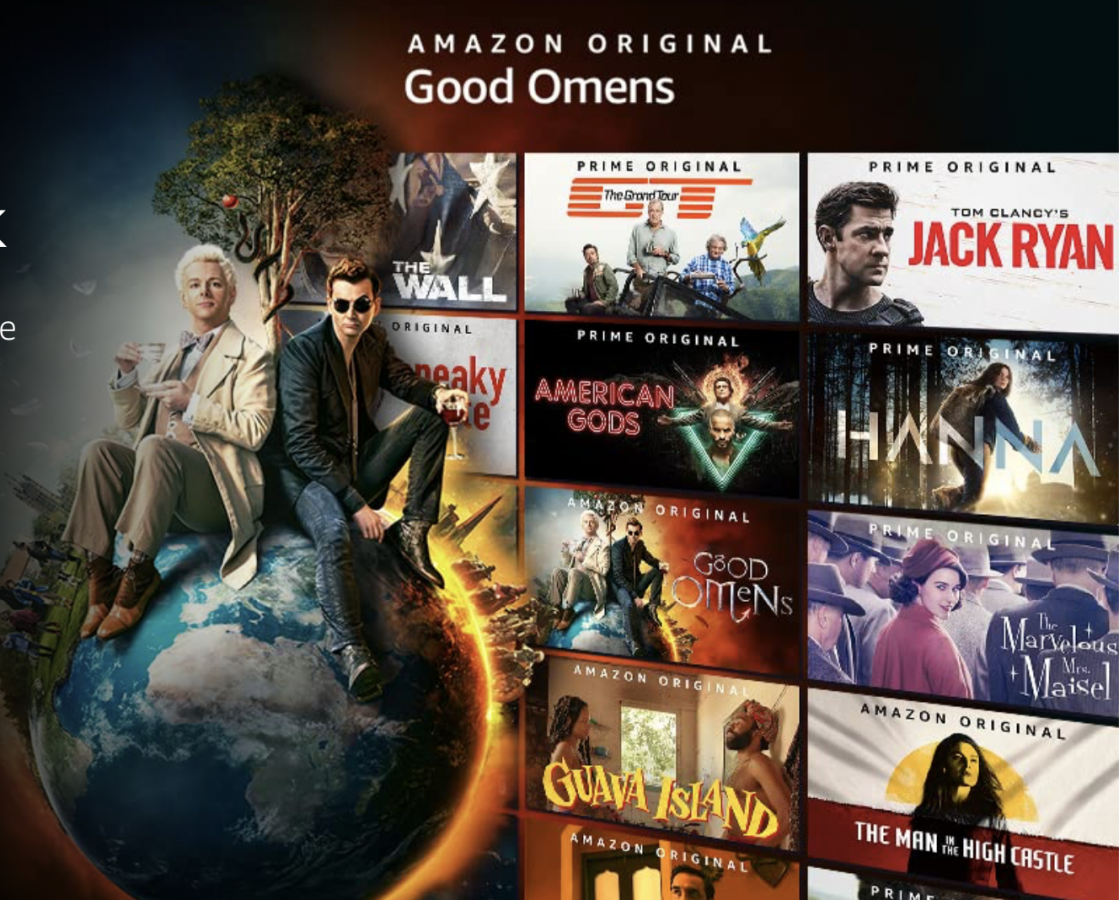

In contrast to the Feeders, most of the Deliverers have emerged from already vertically integrated studio businesses or are new global streaming entrants such as Netflix or Amazon. They need a way to boost their ability to get in front of viewers on a global basis.

For the Deliverers, vertical integration will be the prevailing trend, meaning content and distribution. Big tech plus major content combinations will emerge in a remodelling of the nineties and noughties trend that saw regionally limited cable and satellite players join forces with channel and content assets. The Amazon/MGM deal is a precursor to this movement. It underlines the vital importance of controlling global rights and protecting IP in this environment.

Bisson concluded by saying: “The need to control global rights drove the first waves of production M&A activity as streaming took off. In 2022, content M&A will increasingly shift to focus on intellectual property, the control of characters and their associated fan bases. Already, 40% of new streaming TV show commissions are based on existing IP so the future means not just controlling global rights, but also managing the source of new and franchisable content”.