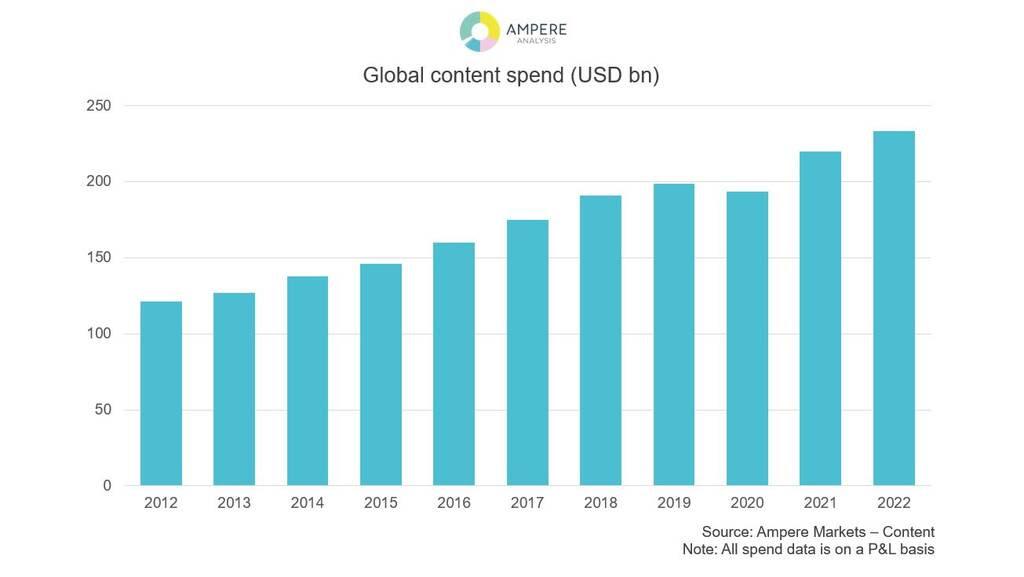

Global content spend saw double digit growth and is expected to exceed $220 billion this year.

Global content spend saw double digit growth and is expected to exceed $220 billion this year.

According to a new report by Ampere Analysis, growth has been driven by SVOD platforms. Investment rose 14% compared to last year, representing an increase of over $20 billion.

It adds that Apple TV+, Disney+, HBO Max, Peacock and Paramount+ invested over $8 billion in original content in 2021.

Content expenditure by commercial and public service broadcasters bounded back this year, after being damaged in 2020 by ad spend cut-backs and production halts during the earlier phases of the Covid-19 pandemic. Despite this recovery, content spend from these groups still remains below 2019 levels, largely due to ongoing pressures on revenue (primarily TV advertising revenue) – a consequence of a mixture of viewing shifts to online video, and lingering economic effects influencing advertiser expenditure.

However, subscription OTT services increased investment in content by 20% in 2021, to nearly $50 billion. Compared to 2019, this represents a growth of over 50%, a factor of the success of the streaming market during lockdown, and that within this time frame, Apple TV+, Disney+, HBO Max, Peacock and Paramount+ have expanded rapidly and together via their originals, contributed over $8 billion to content spend in 2021.

However, subscription OTT services increased investment in content by 20% in 2021, to nearly $50 billion. Compared to 2019, this represents a growth of over 50%, a factor of the success of the streaming market during lockdown, and that within this time frame, Apple TV+, Disney+, HBO Max, Peacock and Paramount+ have expanded rapidly and together via their originals, contributed over $8 billion to content spend in 2021.

Commenting on the findings of the report, Hannah Walsh, research manager at Ampere Analysis, said: “In 2022, we expect content investment to exceed $230 billion, primarily driven by subscription streaming services, as the battle in the original content arena intensifies – both in the US, but also in the global markets which are increasingly key for growth”.

Netflix continues to dominate SVOD content investment, contributing 30% of total SVoD content spend and 6% of total global content investment in 2021. Netflix is the third largest investor in professional video content at a group level ($14 billion), behind Comcast and its subsidiaries ($22.7 billion), and Disney ($18.6 billion).

Walsh continued: “Comcast and Disney invest heavily in sports rights, which – alongside their hefty investments in original content – contributed to their leading positions in the table. Sports rights made up of over a third of both Comcast and Disney’s spend in 2021.”