In Australia, scheduled TV and subscription video-on-demand (SVOD) services have been engaged in a battle for viewers’ time, and now the gap between them has closed, according to exclusive research by Ampere Analysis.

In just two years, SVOD’s claimed viewing proportion grew from 14% in Q3 2017, to almost one quarter (23%) in Q1 2019. In the same period, linear TV viewing has fallen from half (49%) to 36% of viewing time.

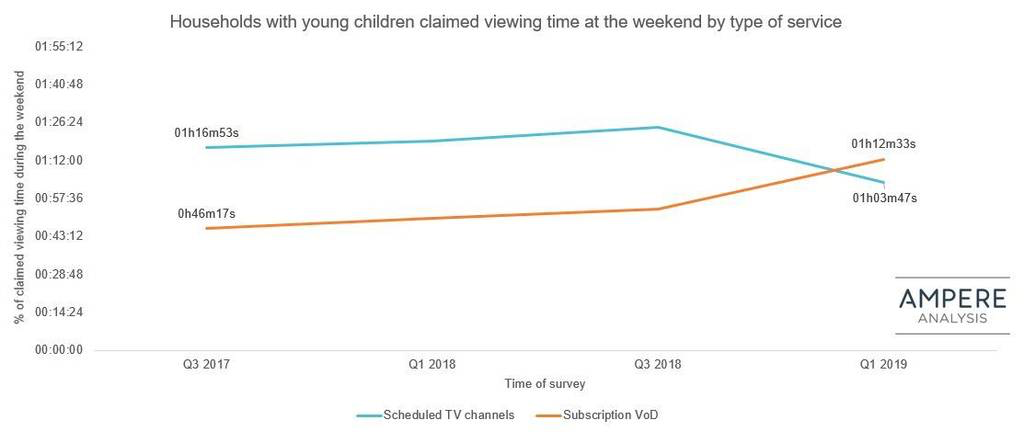

The shift from scheduled TV to SVoD is even bigger for weekend viewing which has passed the one-hour mark on SVOD per respondent, bringing it closer to linear TV. The proportion of self-claimed SVOD viewing during the weekend grew from 16% in Q3 2017 to 27% in Q1 2019. The gap with scheduled TV has decreased to less than 20 million viewers.

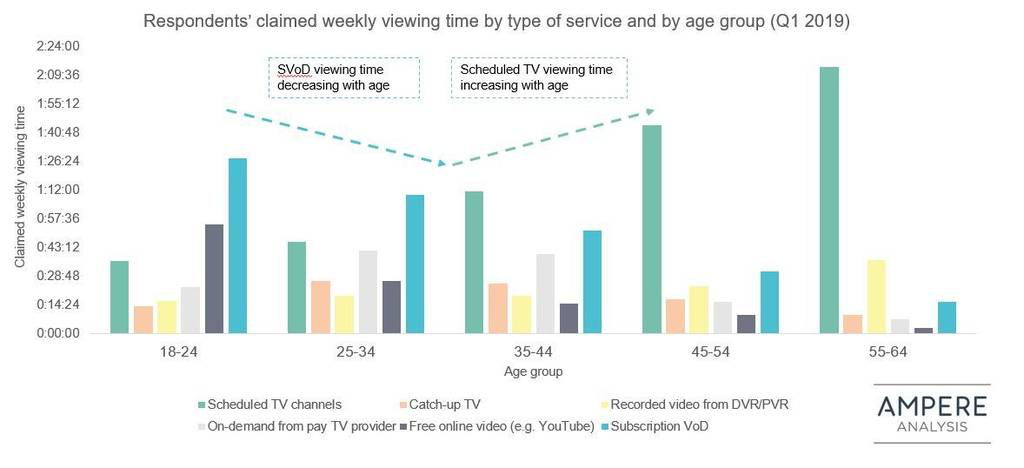

In Australia, consumers aged 45-64 favour scheduled TV

The analysis shows that scheduled TV is mainly viewed by those in the 45-64 age range. In contrast, younger respondents aged 18-24 spend most of their viewing time on SVoD and free online video platforms such as YouTube.

SVOD adoption is driven by households with kids

The move to SVOD is mainly driven by families with young children (aged 10 and under), who spend more time watching programmes on streaming services than on scheduled TV. This transition has happened quickly: just two years ago, families with young kids were spending twice as much time on scheduled TV compared to the SVOD platforms.

Alexios Dimitropoulos, Senior Analyst at Ampere says: “These findings demonstrate a fundamental shift in viewing across the generations in Australia. Younger consumers spend more than twice as much time watching subscription-video-on-demand (SVoD) content than linear TV, and over 50% more time on free online video more than linear TV. Older consumers’ behaviour is exactly the opposite, with 83% of their viewing time spent on linear TV and time-shifted content (DVR/PVR recordings of linear TV). These drastically different viewing habits mean that advertisers need to consider their medium choice carefully depending on the demographic profile of their target audience. With major services like Netflix offering ad-free experiences, the importance of ad-funded free online video such as YouTube to advertisers increases.”