The OTT subscription online video-on-demand market in Europe should keep growing over the next five years, with Kagan, a media research group within S&P Global Market Intelligence.

The OTT subscription online video-on-demand market in Europe should keep growing over the next five years, with Kagan, a media research group within S&P Global Market Intelligence.

The research company is projecting the market to reach $6.8 billion in revenues in 2022, up from $3.9 billion in 2017. The main factors contributing to this development are the presence of localised Netflix throughout the region, the expansion of Amazon.com Inc.’s Amazon Prime Video as a stand-alone service, the debut of international OTT services such as Turner’s HBO and Naspers’s Showmax as well as the strengthening of offerings from local media providers (i.e. Sky’s Now TV, ProSiebenSat.1 Media’s Maxdome, etc.).

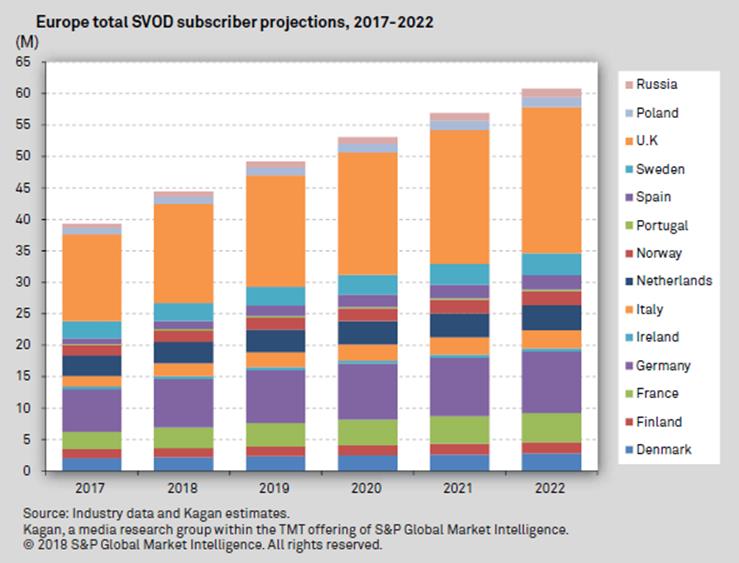

According to Kagan estimates, total paid subscriptions in the above group of countries will grow from 39.3 million in 2017 to 60.8 million in 2022, a compound annual growth rate of 9.1%. This number represents paid subscriptions to online video services and excludes registered accounts through sale promotions or multiplay bundles.

Netflix leads in active paying users in all countries but Germany, Poland and Russia. The online giant has been investing heavily in local content in the majority of the European markets where it operates.

Amazon Prime Video leads in Germany – having capitalised on the earlier success of Amazon Prime.

In Eastern Europe, local services have been able to dominate even when facing bigger international entrants. The majority of these services adopt a hybrid AVOD/TVOD/SVOD model focusing predominantly on advertising to generate revenues.

The UK has Europe’s highest number of SVOD subscriptions, more than double those in Germany in 2017 – Kagan expect this to continue over the next five years

France, which currently ranks fourth behind the Netherlands, is expected to outperform its neighbour and capture the third spot at the end of 2019 – due to the French market having only 10.3% SVOD to broadband homes penetration, compared to 45.1% in the Netherlands in 2017, leaving room for further growth.

SVOD services are especially popular in the Nordics, with Denmark, Norway and Sweden ranking as the countries with the highest penetration rates, ranging from 76.2% to 86.1% in 2017. This can be attributed to the countries’ high percentage of English-speakers as well as disposable incomes higher than the European average.

The UK follows with 59% SVOD to broadband household penetration, surpassing Germany and France, Russia, Spain and Portugal are the three least SVOD-penetrated markets in Europe

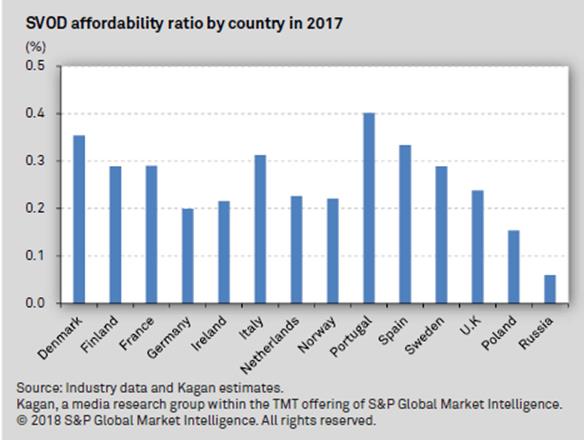

Looking at 2017 estimated gross national income purchasing power parity (GNI PPP) indexes by country combined with the average monthly cost of a subscription to a video-on-demand service provides an indicator of SVOD affordability for a market’s average household. Even though Denmark is the country with the highest average monthly subscription cost of $13.41, it is the Portugal market where SVOD services are the least affordable to subscribe to with an index of 0.4%.

Russia is the most affordable country to pay for a monthly online video subscription, with an index of 0.06%. This is influenced by alarmingly high levels of piracy, income inequality, prevalence of free ad-funded services and a dominant multichannel sector.