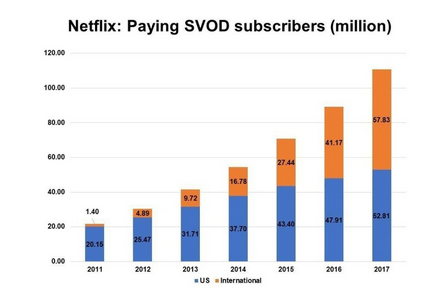

Netflix said that it grew streaming revenue 36% to over $11 billion, added 24 million new memberships (compared to 19 million in 2016), achieved for the first time a full-year positive international contribution profit, and more than doubled global operating income.

Netflix said that it grew streaming revenue 36% to over $11 billion, added 24 million new memberships (compared to 19 million in 2016), achieved for the first time a full-year positive international contribution profit, and more than doubled global operating income.

In Q4, Netflix registered global net adds of 8.3 million, the highest quarter in its history and up 18% vs. last year’s record 7.05 million net adds. This exceeded the company’s 6.3m forecast.

In the US, memberships rose by 2.0 million (vs. forecast of 1.25m) bringing total FY17 net adds to 5.3million.

Internationally, Netflix added 6.36 million memberships (compared with guidance of 5.05m), a new record for quarterly net adds for this segment. With contribution profit of $227 million in 2017 (4.5% contribution margin), the international segment delivered its first full year of positive contribution profit.

Average paid streaming memberships rose 25% year over year in Q4. Combined with a 9% increase in ASP, global streaming revenue growth amounted to 35%. Operating income of $245 million (7.5% margin) vs. $154 million prior year (6.2% margin) was slightly above the company’s $238 million forecast. Operating margin for FY17 was 7.2%, on target with its goal at the beginning of this year.

Netflix is upping its spend on marketing and content production: “Big hits like 13 Reasons Why, Stranger Things and Bright result from a combination of great content and great marketing. We’re taking marketing spend up a little faster than revenue for this year (from about $1.3B to approximately $2B) because our testing results indicate this is wise. We want great content, and we want the budget to make the hits we have really big, to drive our membership growth. We’ll grow our technology & development investment to roughly $1.3 billion in 2018.”

The company plans to extend coopeation with platform operators and internet service providers: “We are partnering with a growing number of MVPDs and ISPs across the world to the benefit of our mutual customers. These partnerships make it easier for consumers to sign up, enjoy and pay for Netflix, while our service allows our partners to deepen their relationships with these subscribers. Examples of these types of partnerships that we struck in Q4 include an expanded global partnership with Deutsche Telekom and with Cox Communications and Verizon Communications in the US. As expected, the FCC removed the US net neutrality rules. We believe that a strong internet should have enforceable net neutrality rules, so we and other internet firms are backing the Internet Association’s challenge to the FCC’s action.”

In its Q4 earning s statement, Netflix also analyses its competitors: “We have been talking about the transition from linear to streaming for the past 10 years. As this trend becomes increasingly evident, more companies are entering the market for premium video content. On the commercial-free tech side, Amazon Studios is likely to bring in a strong new leader given their large content budgets, and Apple is growing its programming, which we presume will either be bundled with Apple Music or with iOS.

“Facebook and YouTube are expanding and competing in free ad-supported video content. With their multi-billion global audiences, free ad-supported internet video is a big force in the market for entertainment time, as well as a great advertising vehicle for Netflix.

“Traditional media companies are also expanding into streaming. Disney is in the process of acquiring most of 21st Century Fox and plans to launch a direct-to-consumer service in 2019 with a beloved brand and great franchises. The market for entertainment time is vast and can support many successful services. In addition, entertainment services are often complementary given their unique content offerings. We believe this is largely why both we and Hulu have been able to succeed and grow.”

In realted news, the company also announced that Eutelsat CEO Rodolphe Belmer is joining Netflix board of directors.

(Chart courtesy Simon Murray of Digial TV Research)