Cisco and Arris take different directions in video leadership battle. Technicolor completed the acquisition of Cisco’s video CPE business in November and the Arris acquisition of Pace is now virtually guaranteed to proceed.

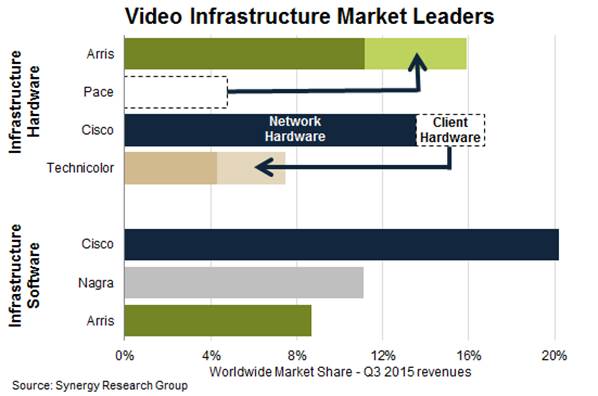

In Q3 Arris and Pace in aggregate generated video hardware revenues that were just 5% short of Cisco’s total video hardware revenues, according to the Synergy Research Group. Had Cisco’s CPE business already been divested, then Arris/Pace would have been 17% ahead, though Cisco would still be the second-ranked video hardware vendor thanks to its dominance of the network hardware segments.

Meanwhile Technicolor’s share of hardware revenues would jump to almost 8% if it included the acquired Cisco assets. On the software side of the market Cisco’s share is over 20% and far ahead of its nearest rivals – Nagra and Arris.

The current M&A deals are being driven by changes in the client hardware (or CPE) market. Revenue growth has mostly gone from this mature market and success is predicated on the ability to generate margins from high-volume global operations. By contrast the network and software sides of the market continue to grow steadily but require a different business focus.

“While in some senses Cisco and Arris will remain direct competitors, it is clear that their strategies are fundamentally different and they are headed in distinctly divergent directions,” said John Dinsdale, a chief snalyst and research director at Synergy Research Group.

“Cisco is doubling down on all things cloud, network and software, and being a major player in a high-volume CPE business does not sit well with that strategy. Arris has clearly decided that its future lies in carving out a large share of the global video client device market.”