Pay TV revenues [subscriptions and on-demand] in North America peaked in 2013 at $102.86 billion, according to a new report from Digital TV Research.

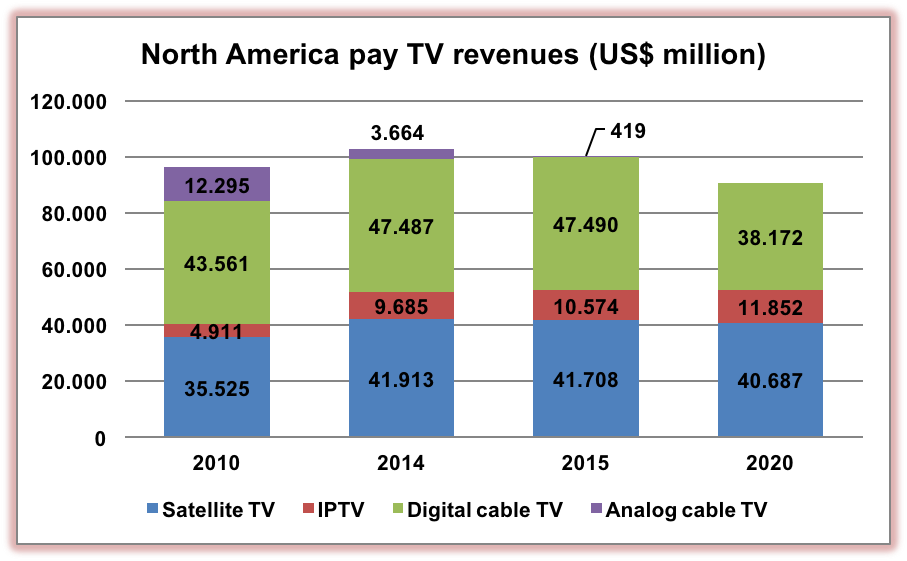

The latest edition of the Digital TV North America report forecasts that revenues will fall by 11.7% or $12.04 billion between 2014 and 2020 to $90.71 billion in 2020.

Cable revenues in Canada and the US will decline by $12.98 billion – $3.66 billion less from analog cable and $9.32 billion lower for digital cable. Satellite TV will lose a further $1.23 billion, but IPTV will climb by $2.17 billion.

There were 67.8 million cable TV subs in 2010, of which 17.5 million were analog, but this total will fall to 56.6 million by 2020.

Satellite TV will overtake cable to become the largest pay TV platform earner in 2019. However, satellite TV revenues will fall by $1.2 billion between 2014 and 2020 – to $40.69 billion.

Although there has been a recent slowdown in subscriber growth, the number of homes paying for IPTV will climb by 23% between 2014 and 2020 to reach 18.05 million – or to 13.5% of TV households.

The number of traditional pay TV subs will remain flat at 110 million. However, pay TV penetration will drop from 86.7% in 2010 to 82.6% by 2020 as the number of TV households climbs. The number of homes not paying for TV services will increase from 18.9 million in 2010 to 26.3 million in 2020.

OTT will paint a much brighter picture. Digital TV Research forecasts that OTT revenues will reach $10.39 billion in 2020, up from $6.85 billion in 2014 and $2.02 billion in 2010. These figure do not include advertising revenues for the OTT players.

Simon Murray, Principal Analyst at Digital TV Research, said: “We do not see the OTT revenues coming solely at the expense of traditional pay TV. Most of the revenues will come from existing pay TV subscribers.”

The number of SVOD subscribers will reach 66.85 million in 2020, up from 50.62 million in 2014 and 16.68 million in 2010. SVOD revenues will reach $6.91 billion in 2020, up by $2 billion on 2014.

Download-to-own revenues will almost double between 2014 and 2020 to $2.47 billion in 2020, with a similar story for rental revenues ($1.01 billion in 2020).

For more information on the Digital TV North America Forecasts report, please go to the Broadband TV News webshop.